Article 325bb Expected shortfall risk measure | Regulation 575/2013/EU - Capital Requirements Regulation CRR (UK CRR as onshored by HM Treasury) (Assimilated Law) | Better Regulation

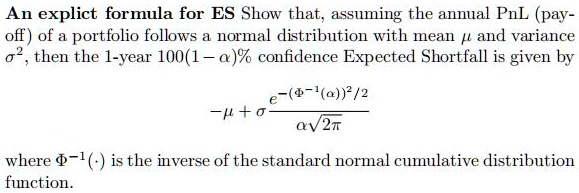

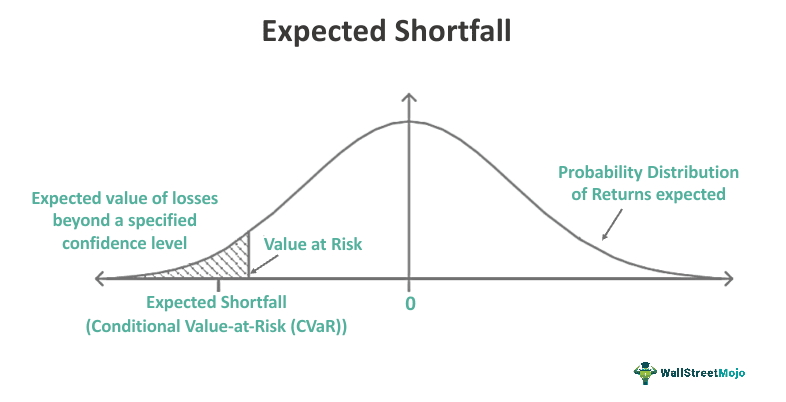

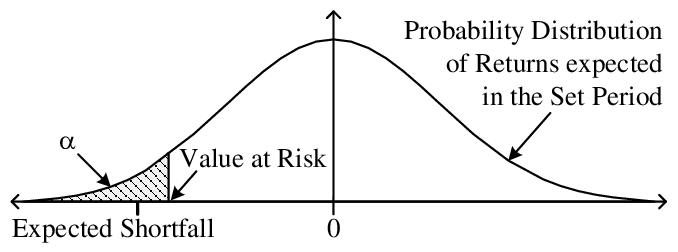

Understanding the paper “Expected Shortfall: a natural coherent alternative to Value at Risk” for the (almost) layman and through a hands-on Python approach – Software Developer – Capital Markets

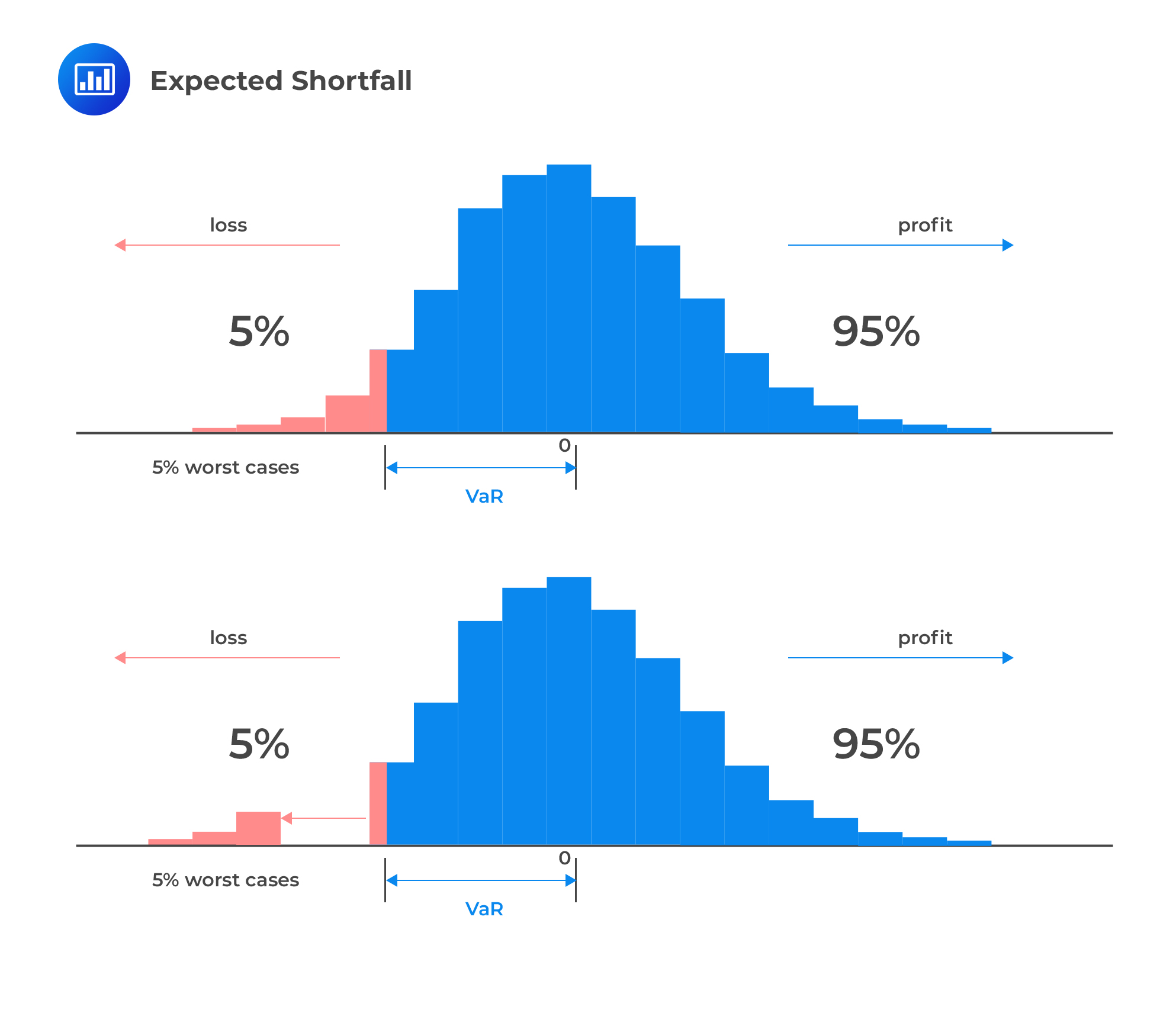

Monte Carlo Methods for Risk Management: VaR Estimation in Python | by Andrea Chello | The Quant Journey | Medium